Sales and use tax computation

Multiply by the sale price. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

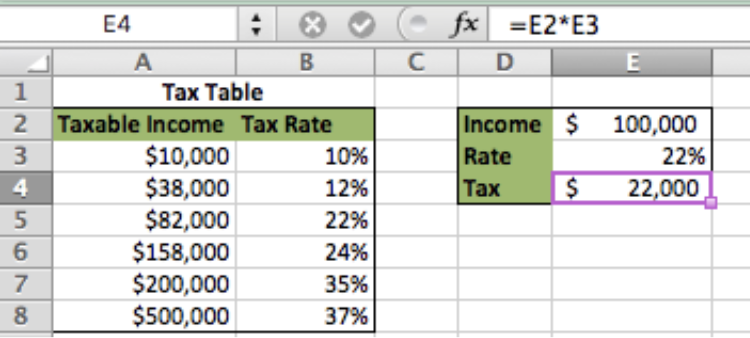

How To Calculate Sales Tax In Excel

By statute the 6 sales and use tax is imposed on a bracketed basis.

. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. The Nebraska state sales and use tax rate is 55 055. The following sales tax calculation.

References and other useful information. Aviation Gasoline and Jet Fuel. General Tax Adminisraon Program.

Individuals who do not have a permanent sales tax license are required to obtain a temporary license and collect a 6 percent or 9 percent. Notice of New Sales Tax Requirements for Out-of-State Sellers. Temporary Sales and Use Licenses.

To use this formula you first need to add up all applicable sales taxes. Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax. The Nebraska state sales and use tax rate is 55 055.

The sales tax is comprised of two parts a state portion and a local. Sale amount 1438 the tax rate 65. Dry Cleaners Laundries Apparel and.

Vertex is the leading and most-trusted provider of comprehensive. You can automate sales tax calculation on every transactionfast and securely. Hit enter to return to the slide.

In transactions where sales. Tax Rate Calculation Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and. If only the state sales or use tax of 6 applies divide the gross receipts by 106 as.

Streamlined Sales and Use Tax Project. Gather local sales tax rate information. Ad Get Your Business Sales Tax In Order.

Use the sales tax formula to find the sales tax amount and the final sales price the customer owes. The third decimal place is four so the tax would be rounded to the nearest whole cent and would be 93. General Sales and Use Tax.

Add the sales tax to the sale price. Businesses and Self Employed. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

Streamlined Sales and Use Tax Project. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Floridas general state sales tax rate is 6 with the following exceptions.

Local taxing jurisdictions cities counties. Sections 1105 1110 1118 1132 and 1133 Regulations. Add up all the sales taxes.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. Parts 525 and 531 Publications. Sales Use Taxes information registration support.

Stress Free Hassle Free Sales Tax Mgmt. DAVO Sets Aside Files Pays Sales Tax. How o Calculae and Pay Esmaed Sales and Use Tax.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Aircraft and Qualified Jet Engines. How to Calculate and Pay Estimated Sales and Use Tax.

The tax calculation would be 09347. Ad Avalara Consumer Use Reconciles Transactions and Automates Your Use Tax Compliance. Publication 750 A Guide to Sales.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Explore sales and use tax automation. On Time In Full Guaranteed.

The amount of tax due is determined by the sale price in relation to the statutorily imposed brackets. Ad New State Sales Tax Registration. Open to any RSM office in the Northeast RSM is seeking an experienced and self-motivated sales and use tax automation specialist to join our.

For retail sales and use tax assessments issued on or after October 2 1999 Virginia Tax will allow the taxpayer to calculate an Alternative Method of computing the use tax ratio that takes.

Sales Tax Calculator

Softax Private Limited 3 Hours Workshop On E Filing Of Income Tax Return Tax Year 2018 Step By Step Understanding Income Tax Return Income Tax Tax Return

An Exclusive Solution For All Your Tax Filing Needs Features That Help You Make Tax Filing 100 Accurately Spect Filing Taxes Income Tax Return Tax Software

Effective Tax Rate Formula And Calculation Example

Excel Formula Basic Tax Rate Calculation With Vlookup Excelchat

How To Calculate Sales Tax In Excel

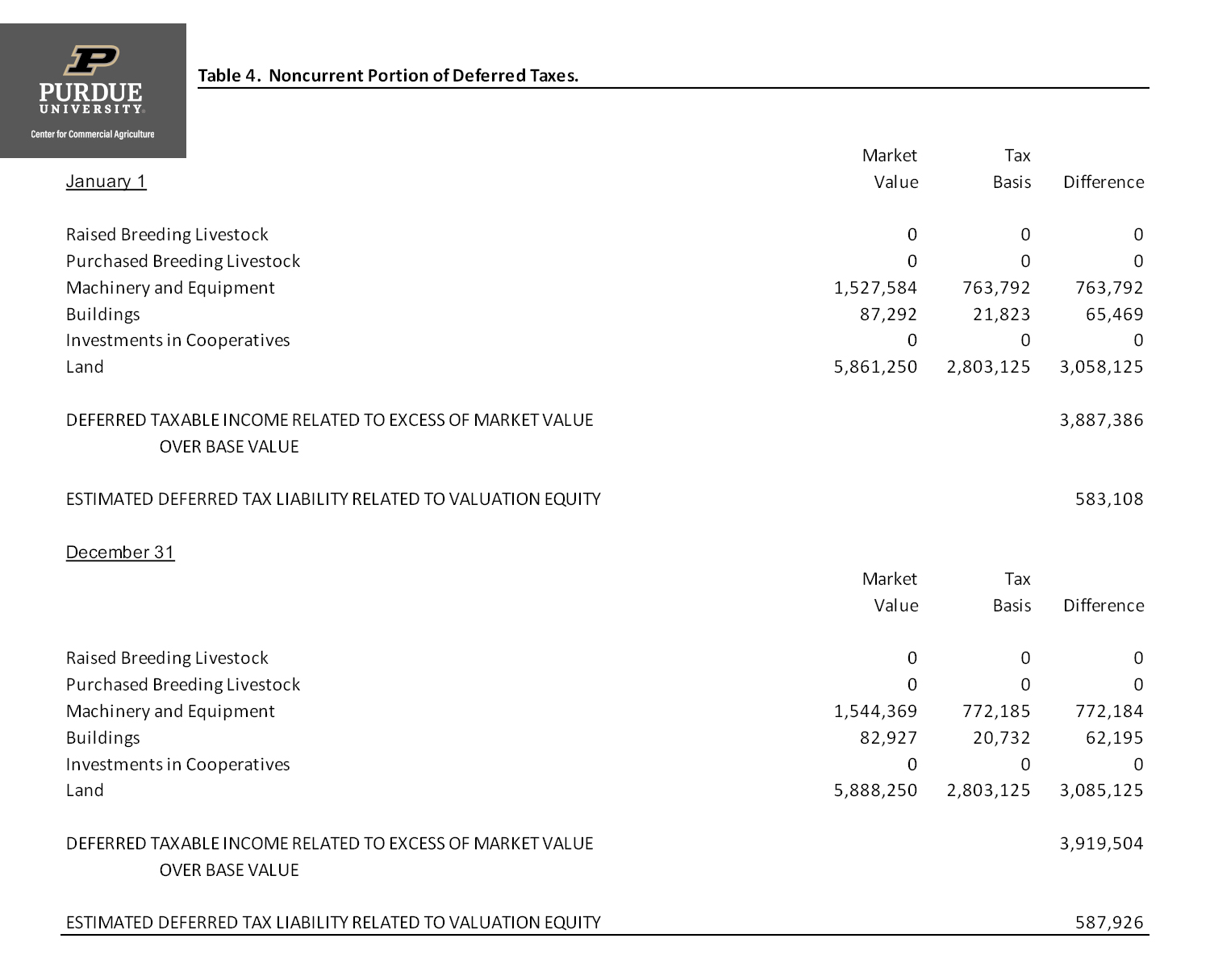

Computation Of Deferred Tax Liabilities Center For Commercial Agriculture

How To Calculate Sales Tax In Excel Tutorial Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

Spectrum Is Designed To Fully Automate The Process Of Tax Computation And Return Preparation Save A Lot More O Tax Software How To Apply Chartered Accountant

Income Tax Computation Format Pdf Simple Guidance For You In Income Tax Computation Format P Tax Forms Income Tax Income

Excel Formula Two Tier Sales Tax Calculation Exceljet

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Sales Tax In Excel

Small Business Tax Deductions Small Business Tax Business Tax Deductions

Small Business Tax Deductions Small Business Tax Business Tax Deductions

How To Calculate California Sales Tax 11 Steps With Pictures